1095-c Filing Requirements

One would think that the GOP campaign promise to Repeal & Replace Obamacare would at the very least focus on the administrative burden that ACA placed on employers and its employees. Not to mention finding a great alternative to actual Health Care Reform. The political shortfall of promises have proven to continue. The Senate Health Bills that have been presented fail to remove one of the most burdensome requirement, the IRS Section 6055 and 6056 that are better known as the 1094c & 1095c filings to the IRS.

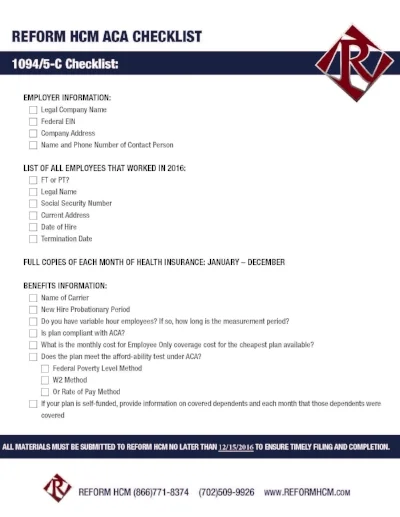

Employers that have employed 50 or more full-time equivalent employees should prepare to file...now. If you are unsure if you meet the requirement to file you can use an FTE Calculator.